[ad_1]

And the way the third-party channel will win ultimately

Know-how

Know-how

By

Ryan Johnson

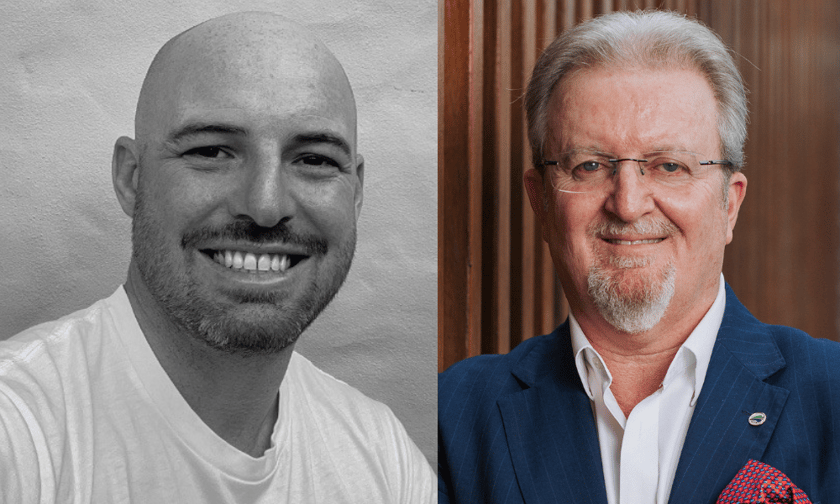

A former founding father of a direct digital dwelling mortgage fintech, Clint Howen (pictured above left), has questioned the viability of the direct dwelling mortgage channel, as lenders make use of controversial techniques to win over the dwindling direct market.

The feedback come after Unloan, the direct mortgage arm of Commonwealth Financial institution (CBA), launched a brand new referral program providing 0.33% fee to professionals like accountants and attorneys for referring purchasers who settle mortgages.

Notably, this fee scheme excludes brokers.

The transfer has sparked criticism from the mortgage business, with FBAA managing director Peter White (pictured above proper) calling out the “grubby” follow of introducer referrals, which was closely denounced in the course of the Hayne Royal Fee over conflict-of-interest issues.

However whereas direct lenders goal rate-sensitive customers by way of heavy advertising, Howen stated “brokers have the antidote” by way of sound recommendation, which holds “a lot better worth” in the long term.

“As brokers, we perceive this,” stated Howen, director of WealthX.

“It is essential to not step over {dollars} to choose up cents, and brokers play a major position in educating purchasers that decrease rates of interest do not all the time imply a greater end result; it is only one piece of the story.”

What’s Unloan’s referral program?

At the moment being piloted, Unloan’s referral program is open to accountants, conveyancers, monetary planners, attorneys, and actual property brokers who’ve an energetic ABN and are registered for GST.

Authorised professionals obtain a singular monitoring hyperlink to share with purchasers. If a consumer makes use of the hyperlink to use for and efficiently settle a mortgage with Unloan, the introducer earns a 0.33% fee on the mortgage quantity.

For instance, if an actual property agent refers a consumer to Unloan and the consumer’s $1 million mortgage settles, the agent earns $3,300 fee.

On its web site, Unloan urged referrers to not present the client with any monetary recommendation, as “it’s as much as buyer to make their very own choices”.

However White stated {that a} referrer having such a monetary incentive to advertise a person financial institution is “not in the perfect pursuits of the borrower, however solely in the perfect pursuits of the referrer”.

“It could be the worst deal for the client,” he stated. “Not solely that, however a referrer may have preparations with a number of banks and interact in mortgage churn, as with no clawbacks there may be an incentive to make much more cash.”

“Whereas mortgage brokers do the appropriate factor, act in the perfect pursuits of customers and are topic to unfair clawbacks, referrers can principally do what they need and snort all the way in which to the financial institution, so to talk.”

Whereas that will sound regarding for brokers and debtors alike, Howen, who can also be a dealer, stated it’s a sign that the mortgage dealer finest curiosity obligation mannequin is working.

“It’s apparent that they’re making an attempt to cut back the price of acquisition, or they’ve already exhausted the expansion of the present section of consumers,” he stated. “This highlights how small the section actually is and is one other confirming information level for brokers.”

The issues with the direct market channel

Whereas some may dismiss Howen’s feedback as a dealer’s response to going through competitors from direct lenders, his firsthand expertise with the “quite a few drawbacks” of the direct digital channel provides him a singular perspective on the problem.

The fintech platform, Hero Dealer, hit the market promising that buyers may “be their very own dealer” by way of giving them “good, unbiased entry” to mortgage merchandise.

Whereas Hero Dealer began strongly producing over $2 billion in mortgage functions, key insights emerged.

Though you may generate early enterprise by way of efficient public relations and advertising, Howen stated the section for the direct channel is extremely price-sensitive.

“To offer interesting merchandise with low charges, strict product insurance policies are crucial and It is value noting that many unfavorable opinions for competitively priced direct channels usually come up from the massive variety of candidates they reject,” Howen stated.

One other disadvantage, based on Howen, is the elevated churn.

“Prospects attracted by low charges and solely low charges are more likely to change in the event you do not keep the most cost effective charge out there,” he stated.

“In essence, the method usually entails substantial spending on advertising, rejecting a substantial variety of potential purchasers resulting from coverage constraints (leading to wasted alternatives), and doubtlessly shedding settled purchasers rapidly in case your charges aren’t persistently probably the most aggressive.”

When you can take a look at Hero Dealer’s full insights right here, total, Howen discovered purchasers overwhelmingly most well-liked chatting with an actual individual earlier than continuing with a mortgage.

Howen stated this needs to be seen as a “large win” for the dealer channel.

“The check – if purchasers, when introduced with appropriate choices and incentives like cashbacks, would proceed with a mortgage software with no dealer’s help – resulted in a tough ‘no’.”

Who’s the direct channel focusing on?

With regards to advertising these gives, particularly inside the internet marketing area, Howen stated lenders want to steer with a extremely engaging charge to realize curiosity.

“The time period is sometimes called ‘charge baiting’,” Howen stated.

With a heavy inflow of promoting from the direct channel hitting the screens of potential leads throughout Australia, it begs the query: who’re these advertisements focusing on?

Howen stated in the event you had been to search for any Barefoot Investor Fb group, that may offer you an concept of the section.

“It’s the self-driven, savvy house owner who is extremely rate-sensitive and needs to handle the entire course of themselves,” he stated. “This section is definitely a lot smaller than many imagine it to be, with the mass majority choosing recommendation over DIY.”

What does Unloan must say?

For its half, Unloan sees itself as only a digital dwelling mortgage that may preserve costs low by providing a “easy, digital expertise” that reaches its clients by way of “cost-effective channels”, based on Unloan CEO Dan Oertli.

“If companions need to inform individuals about Unloan by sending them a hyperlink to our digital software, we’re joyful to pay a referral payment if we enter right into a mortgage settlement,” Oerti stated.

“All referral companions are vetted,” Oertli stated. “We perceive the earlier points referring to introducer applications and now we have designed ours with them in thoughts.”

Nonetheless, he stopped wanting dampening the ire of the third-party channel.

Oertli stated the commissions paid are “considerably decrease” than conventional dealer commissions for a purpose.

“… This enables us to supply decrease rates of interest to our clients,” he stated. “We stay open to exploring all cost-effective channels to make individuals conscious of Unloan.”

The way forward for the direct channel: Brokers needn’t fear

With dealer market share rising to a transparent majority within the years because the introduction of finest curiosity obligation (from round 55% in 2018 to 71.5% in 2023), the piece of the general pie is already dwindling for the direct channel.

“It’s actually arduous to see a referral system work when their present product knocks again nearly all of potential clients,” stated Howen. “You really want a big suite of merchandise to help clients to be a trusted referrer, one thing brokers have an enormous benefit in.”

But Howen nonetheless believes there may be area for the direct channel – however just for area of interest merchandise focusing on area of interest segments.

“Though it seems intimidating seeing Unloan and Athena promoting in all places, their fashions aren’t proving worthwhile, and market breakthroughs and constructive opinions aren’t evident,” Howen stated.

“Contemplating Unloan’s $5 billion and Athena’s $2.6 billion in settled loans, these figures would seemingly characterize poor outcomes relative to advertising {dollars} spent.

“In distinction, I see good floor being comprised of good digital processes coupled with present dealer channels.”

As for the direct digital channel’s goal buyer, they’re left with a selection:

- Belief a devoted mortgage skilled with a authorized obligation to seek out the best choice from a panel of lenders.

- Belief knowledgeable in one other discipline who income from directing them to a single lender.

As Unloan states on its referral program web site, “relationships are every little thing. We all know clients want to use a lender really useful by knowledgeable they know and belief.”

What do you consider Unloan’s new referral program? Remark under.

Associated Tales

Sustain with the newest information and occasions

Be a part of our mailing record, it’s free!

[ad_2]