Proprietor-occupier loans additionally up

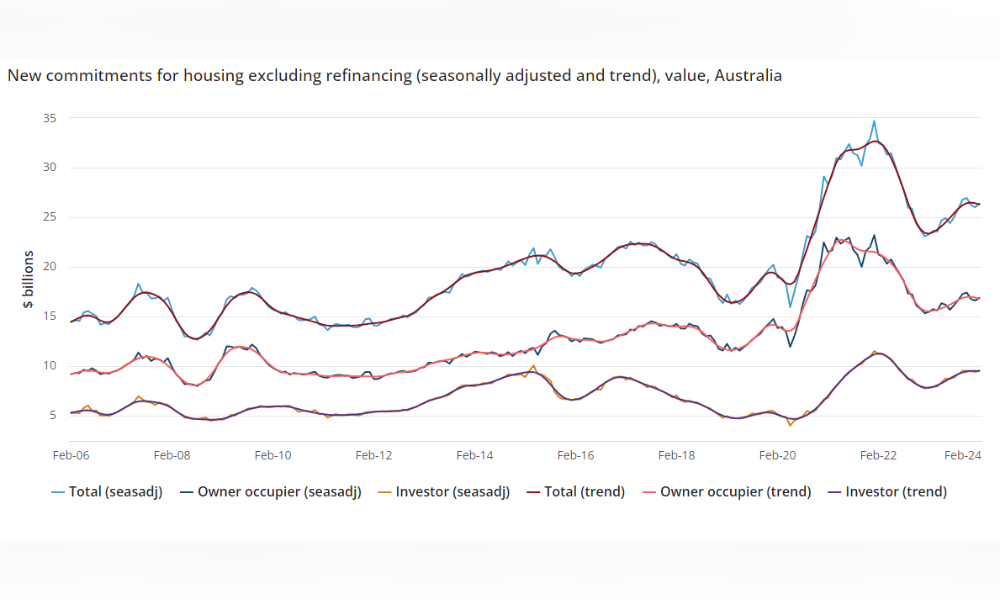

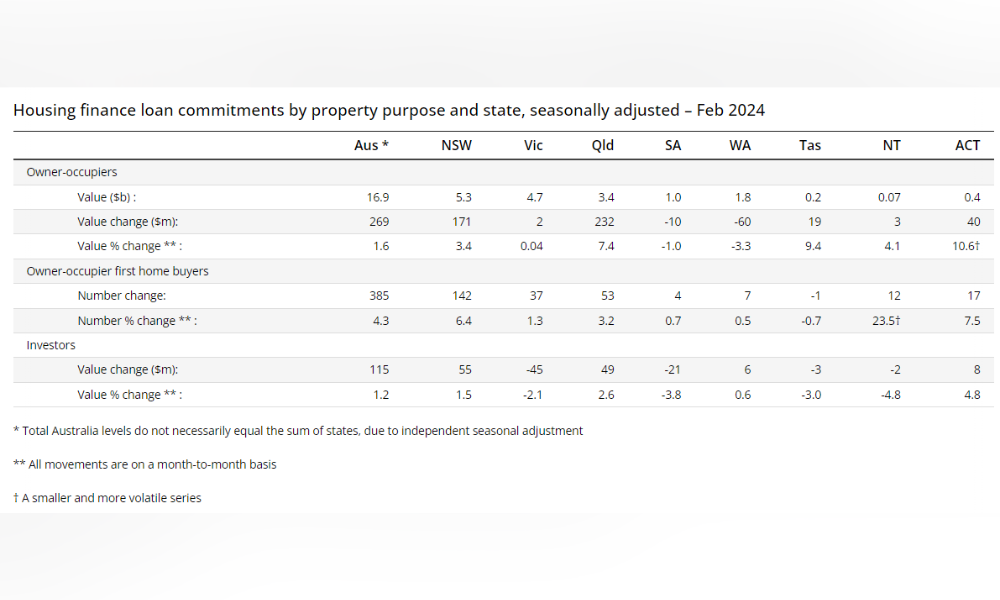

New housing loans to traders skilled a 1.2% enhance in February, indicating a continued curiosity and confidence within the property market amongst traders, based on the most recent knowledge from the Australian Bureau of Statistics.

Mish Tan (pictured above), ABS head of finance statistics, emphasised the importance of the rise.

“The worth of recent investor loans in February was 21.5% larger in comparison with a yr in the past,” Tan stated. “This made up over half of the expansion in complete new mortgage commitments over the previous yr.”

Proprietor-occupier loans additionally up

The ABS report additionally confirmed that the worth of recent owner-occupier loans noticed a 9.1% enhance from the earlier yr, with first-home purchaser loans leaping 20.7% over the identical interval. The overall variety of new owner-occupier loans grew by 0.9% in February, with first-home purchaser loans seeing a 4.3% enhance, marking a 13.2% rise year-on-year.

Private finance shifts

Within the realm of non-public finance, the worth of new mortgage commitments for complete fixed-term private finance noticed a slight decline of 0.9% to $2.4 billion, primarily because of a 2.7% drop in lending for the acquisition of highway automobiles, ABS reported.

Get the most well liked and freshest mortgage information delivered proper into your inbox. Subscribe now to our FREE day by day e-newsletter.

Sustain with the most recent information and occasions

Be a part of our mailing checklist, it’s free!