There’s no have to bemoan the lack of the GrabPay card, because it was hardly that implausible to start with. However for these of you who assume you’ll miss the numberless card characteristic, you’ll be glad to know that whereas Seize was certainly the primary to launch that characteristic right here, 2 different card issuers have adopted since – so right here’s these 2 various choices you possibly can take into account as an alternative.

After I first learn the information yesterday about Seize’s resolution to discontinue their GrabPay card (from June), my first thought was that it might need been an April Idiot’s prank performed by the model.

Besides that it wasn’t.

Shortly after, I acquired a number of DMs on my Instagram from readers asking if I knew of some other playing cards that would supply “related advantages”. That originally left me bewildered, as a result of in my head I used to be considering, “WHAT advantages did the GrabPay card have within the first place?”

You’ve seen me characteristic numerous playing cards right here on the weblog, and I’ve talked extensively about how I’m an everyday Seize consumer right here, right here and right here.

However let’s get actual, that doesn’t imply each Seize providing is nice. And the GrabPay card is prime of that so-horrible-why-does-it-even-exist record.

The historical past of GrabPay card

The GrabPay Card, primarily a pay as you go MasterCard, was launched in late 2019 and again then, had a minimum of some justifiable use instances for it:

That was the ultimate nail within the coffin for the GrabPay card. The modifications not solely rendered the GrabPay card ineffective, but in addition made the all the Seize level methods an excessive amount of effort for too little reward. And let’s be sincere, whereas the GrabPay Card’s reward scheme was respectable at finest, however once you weigh it in opposition to among the heavyweight bank card choices on the market, it’s like bringing a knife to a gunfight. What’s extra, navigating Seize’s rewards system was about as easy as a hedge maze – you’re higher off with out it in your life anyway.

Since then, it has just about been a ineffective card to maintain; you’d be higher off with a specialised card that rewards you for spending on Seize, corresponding to DBS Lady’s World, Citi Rewards or HSBC Revolution for miles (4 mpd) or 10+% cashback with UOB One Card.

Safety as a card profit

Nevertheless, there was one minor card profit left: Seize’s numberless card characteristic.

Bear in mind, again in 2019 when Seize first launched the cardboard, it touted it as Asia’s first numberless bodily card for enhanced safety. That meant that even should you lose your card, you didn’t have to fret about somebody stealing and utilizing your bank card numbers for his or her on-line purchases since your entire card particulars securely saved inside the Seize app, and you might lock the cardboard immediately via the app in case of an emergency (learn: scams).

After a number of voice messages with this reader, I lastly understood why she was nonetheless utilizing the cardboard – it was primarily for her on-line transactions on suspicious-looking web sites. She was additionally wanting right into a numberless bank card for her aged mom to convey out in substitute of her POSB Debit card, so she requested me for assist.

Whereas I personally select to not preserve a card in my arsenal until it has safety AND different advantages (which is why GrabPay didn’t meet my necessities), I’ve to acknowledge that there are some teams of shoppers who don’t thoughts proudly owning a card solely for safety functions.

Besides that…you actually don’t need to settle. Let me inform you why.

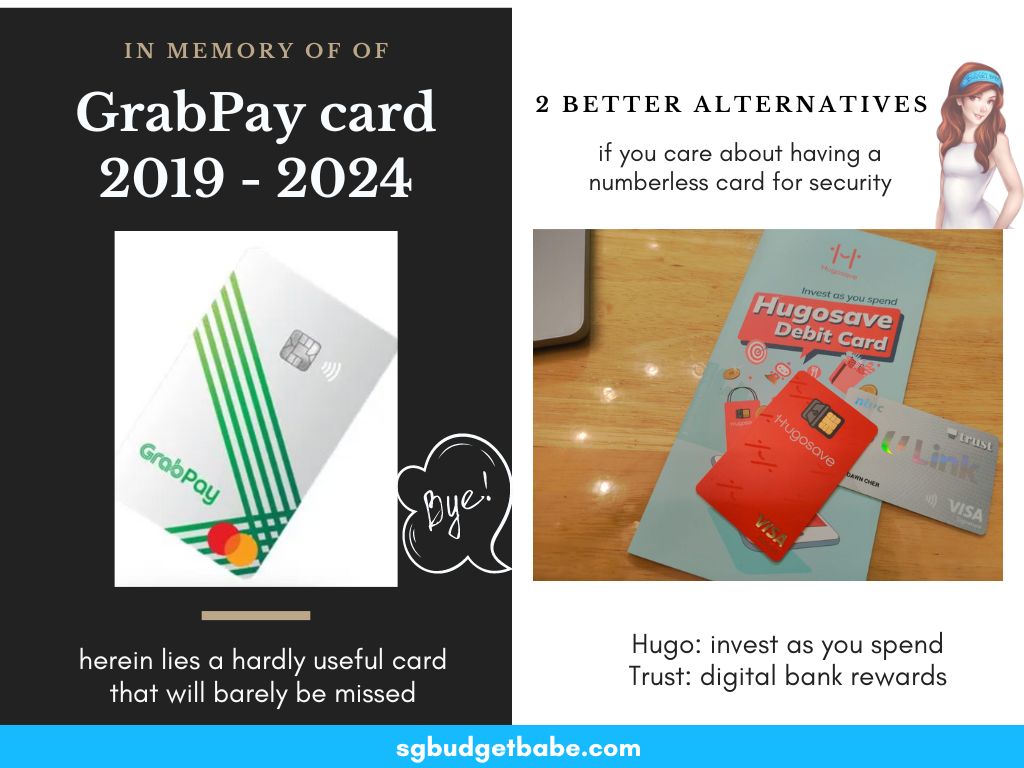

Higher options to the GrabPay card: Belief card and Hugo card

Significantly, should you haven’t ditched your GrabPay card already by now, isn’t it good that this discontinuation now forces you to interrupt up with a card that hardly serves you?

There’s no have to mourn the approaching closure both as a result of actually, there are higher playing cards on the market that may supply BOTH safety and rewards. The GrabPay Card might need been an honest contender in its heyday, however the fintech evolution in Singapore has already levelled up since. So in that sense, the tip of the GrabPay Card isn’t only a closure; it’s an opportunity so that you can stage up your monetary sport.

Utilizing numberless playing cards as the principle precedence characteristic, right here’s 2 playing cards that I like to recommend you guys take a look at to interchange GrabPay card as an alternative – Belief and Hugo.

Belief (financial institution) card

Belief Financial institution Singapore is a digital financial institution backed by Customary Chartered and FairPrice Group, and their Belief bank card can also be a numberless bodily card.

- Your Belief Visa Signature Card is a numberless bank card, which implies that solely you possibly can entry your card particulars on the Belief app. Similar to the GrabPay card. Within the (uncommon) occasion that your card particulars are compromised, you possibly can instantly disable it on the app. You can too set the credit score restrict (I selected a low $1,000 for mine) and modify it anytime, so that you don’t have to fret about scammers siphoning off extra money than you possibly can afford to lose or pay again.

- Cash in your Belief account is safeguarded by Customary Chartered Financial institution with a $100k SDIC safety.

- You get to earn upsized LinkPoints and luxuriate in service provider promos (I’m an everyday at Wang and Burger King with my Belief card perks).

Not like Seize who nerfed their rewards, Belief has truly elevated it (from a beforehand 15% to as much as 21%* financial savings at present on FairPrice Group groceries and meals spend). There are additionally different advantages together with preferential mortgage charges and the choice to purchase low cost insurance coverage ($0.50 monthly) for household accident plans underwritten by NTUC Revenue.

Learn my detailed assessment of Belief financial institution and its card right here to resolve if that is best for you. Whereas the $170 can not be earned since they eliminated the bonus $25 welcome voucher again in 2022, you possibly can nonetheless get a $10 welcome Fairprice e-voucher instantly upon signup and different perks.

Don’t neglect to make use of my referral code earlier than you signal as much as get $10 FairPrice vouchers! Use 0BWH3B31 (that’s a zero in entrance).

Hugo Card

When you like the concept of having the ability to “make investments as you spend”, then Hugo is likely to be proper up your alley:

- Your Hugo Platinum Visa Debit Card is a numberless debit card, which implies that solely you possibly can entry your card particulars on the Hugo app. Similar to the GrabPay card. Within the (uncommon) occasion that your card particulars are compromised, you possibly can instantly disable it on the app and really feel secure that the utmost the scammers can siphon off is restricted to the money you’ve stored in your Hugo debit account.

- It really works like all Visa contactless card would, and cash in your Hugo account is safeguarded by DBS Financial institution i.e. even when Hugo have been to stop operations someday, your cash will nonetheless be there in DBS.

- It “rounds up” your financial savings (something in cents) and invests that spare turn into your Gold vault. I’m in earnings now because of this due to how a lot gold costs have risen since I began utilizing Hugo!

- This card will also be perfect for these of you considering of giving your youngsters or aged dad and mom a Hugo Account + card, since you possibly can load their spending allowance every month (with out worrying about them busting the funds!) and monitor the place they’re spending at. Keep away from a situation of your youngsters spending 1000’s of {dollars} on on-line video games, merchandise or even thriller containers!

You’ll be able to learn my detailed assessment in regards to the Hugo card and its whole app providing right here to resolve if it’s best for you.

TDLR Conclusion: Goodbye GrabPay card, say hey to Belief or Hugo!

As you possibly can see, there actually isn’t any have to mourn the lack of the GrabPay card – I’d say as an alternative that the cardboard ought to have been closed earlier (again in 2022, in all probability) as soon as it ceased to grow to be helpful to most individuals.

And should you assume you’ll miss the numberless card safety characteristic, then take this as your probability to take a look at Belief card or Hugo card as an alternative. I’ve each and use them for various causes (Belief card for my FPG buying, and Hugo for smaller purchases / make investments into gold), however chances are you’ll favor to get simply 1 as an alternative should you’d somewhat preserve your pockets slim.

In brief, right here’s a fast abstract of how the three playing cards stack up:

| Card | GrabPay | Belief Financial institution | Hugo |

| Kind | Mastercard credit score | Visa credit score | Visa debit |

| Cash stored in | Seize | Belief (a digital financial institution by NTUC & Customary Chartered) | DBS Financial institution |

| Rewards | GrabPoints | Linkpoints + 1.5% curiosity on deposits | Auto-invest in gold and treasured metals |

Which can you like?

With love,

Price range Babe

Apply for Belief card right here and key in 0BWH3B31 to get a S$10 FairPrice e-voucher.

Apply for Hugo card right here and begin incomes as much as S$80 Goldback.